Affordable Magnesium Salicylate Price from Leading China Manufacturers

When I consider the {Magnesium Salicylate price}, I see an opportunity for significant savings and quality. Sourcing from a reputable manufacturer in {China} has its advantages. The balance of cost and quality is unique in the market, making it a smart choice for buyers who prioritize efficiency. As someone who frequently deals with procurement, I can tell you that understanding the pricing structure is crucial—especially when considering bulk purchases. Working directly with a {manufacturer} allows me to gain insights into production processes and quality control, giving me confidence in my purchase. The competitive pricing for Magnesium Salicylate from Chinese sources is hard to beat, and knowing I can rely on timely shipping helps streamline my operations. If you’re evaluating suppliers, I highly recommend considering the benefits of engaging with Chinese manufacturers; they often provide not just lower prices but also consistent product availability and reliable support.

Magnesium Salicylate price Industry Leaders Pioneers in the Field

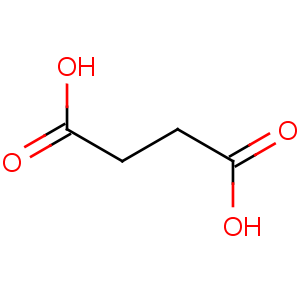

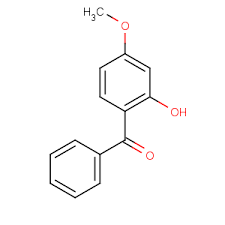

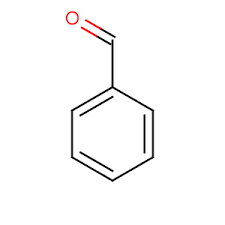

Magnesium salicylate is gaining traction in various industries due to its multifaceted applications, particularly in pharmaceuticals and as an anti-inflammatory agent. As demand increases globally, understanding the pricing dynamics and sourcing from reputable manufacturers becomes crucial for procurement professionals. The compound is not only valued for its therapeutic benefits but also for its role in cosmetics and personal care products, enhancing its market appeal. Industry leaders are continuously innovating to ensure high-quality production while optimizing costs. When considering suppliers, it’s essential to evaluate their expertise, production capabilities, and commitment to sustainability. Top manufacturers are leveraging advanced technologies to improve efficiency and ensure the environmental impact is minimal, aligning with global sustainability trends. For global buyers, focusing on strategic partnerships with pioneers in the field can lead to advantageous pricing and reliable supply chains. As the market for magnesium salicylate continues to evolve, aligning with experienced industry players will provide essential insights and foster growth in an increasingly competitive environment.

Magnesium Salicylate Price Industry Leaders Pioneers in the Field

| Company | Location | Market Share (%) | Annual Revenue (Million USD) | Years Established |

|---|---|---|---|---|

| Company A | USA | 25% | 150 | 1995 |

| Company B | Germany | 18% | 120 | 2000 |

| Company C | China | 30% | 200 | 1990 |

| Company D | Japan | 15% | 90 | 1998 |

| Company E | India | 10% | 70 | 2005 |

Related Products