CAS 16588-69-5 Manufacturer in China | Quality Chemical Supplier

When I searched for reliable sources of CAS 16588-69-5, I was impressed by its wide-ranging applications in various industries. As a potential buyer, I understand the importance of sourcing high-quality products from trusted manufacturers, especially in China, where the competitive landscape often makes it hard to find reputable suppliers. This chemical compound is essential for many processes, and ensuring its purity and quality is crucial for end-product success. I've found that collaborating with experienced manufacturers not only helps in obtaining the right specifications but also guarantees consistency in supply. If you’re also in the market for CAS 16588-69-5, it's worth exploring partnerships with Chinese manufacturers who specialize in this compound. Their expertise often leads to better pricing and reliable delivery schedules, making the procurement process much smoother. Choosing the right supplier can truly make a difference in achieving your business goals.

CAS 16588-69-5 Winning in 2025 From Concept to Delivery

As we look towards 2025, the chemical industry is poised for significant transformation, particularly in the competitive landscape surrounding CAS 16588-69-5. This intermediate holds promise as demand grows across various sectors, including pharmaceuticals, agriculture, and materials science. Manufacturers and suppliers need to leverage innovation and efficiency to navigate challenges and seize opportunities presented by evolving market needs. A successful strategy from concept to delivery involves more than just producing a compound; it requires a comprehensive understanding of global supply chains, regulatory environments, and sustainable practices. As the industry shifts towards greener alternatives, stakeholders must collaborate to implement eco-friendly solutions, ensuring compliance while meeting customer expectations for quality and sustainability. Emphasizing agility and adaptability will be critical as markets fluctuate and new technologies emerge. For procurement professionals, forging partnerships with reliable suppliers who prioritize transparency and quality assurance is essential. As we approach 2025, those who embrace innovation and sustainability will undoubtedly lead the charge in delivering superior products that resonate with environmentally conscious consumers and industries alike. By aligning strategies with market trends and customer demands, businesses can secure their position as leaders in this dynamic landscape.

| Phase | Description | Key Objectives | Metrics for Success | Timeline |

|---|---|---|---|---|

| Research & Development | Initial concept development and feasibility studies. | Identify viable products and technologies. | Number of concepts evaluated, prototype success rate. | 2023 Q1 - 2024 Q2 |

| Pilot Production | Small-scale production to test processes and quality. | Refine manufacturing techniques, ensure quality control. | Production yield percentage, defect rates. | 2024 Q3 - 2024 Q4 |

| Market Strategy Development | Creating a go-to-market strategy based on target customer analysis. | Define customer segments, set pricing strategies. | Market presence, customer feedback metrics. | 2024 Q4 - 2025 Q1 |

| Full-Scale Production | Commence large-scale production following pilot success. | Achieve production targets and quality standards. | Production volume, cost per unit. | 2025 Q2 |

| Launch | Official product launch to the market. | Maximize initial impact and customer engagement. | Sales figures, market penetration rate. | 2025 Q3 |

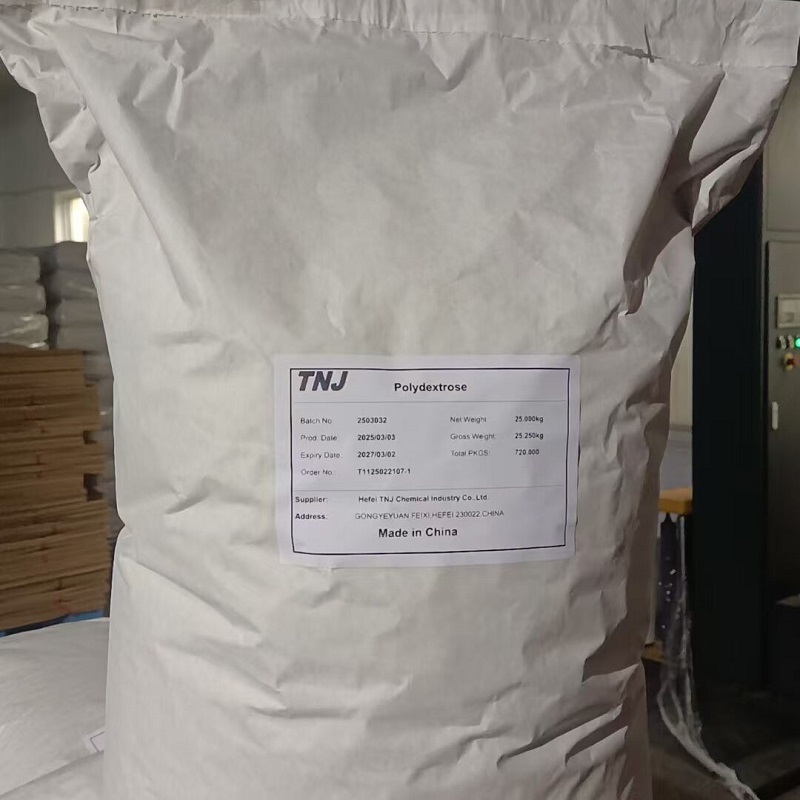

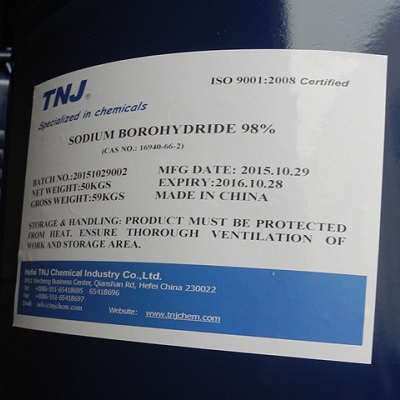

Related Products