- Getting started

- CAS 98349-22-5,Buy 2 4 5-Trifluorobenzonitrile, C7H2F3N,2 4 5-Trifluorobenzonitrile price, 2 4 5-Trifluorobenzonitrile suppliers, 2 4 5-Trifluorobenzonitrile factory, 2 4 5-Trifluorobenzonitrile manuf

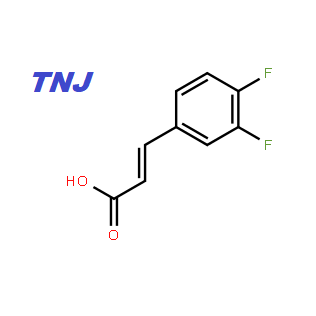

CAS 98349-22-5 2,4,5-Trifluorobenzonitrile Manufacturers in China

Are you in the market for high-quality 2,4,5-Trifluorobenzonitrile? With a CAS number of 98349-22-5, this compound, C7H2F3N, is essential for various industrial applications. Our competitive pricing and direct access to suppliers in China make sourcing easy and cost-effective for your business. Whether you're interested in bulk purchases or finding a reliable manufacturer, we cater to your specific needs. Our factory offers consistent quality and timely delivery, so you can trust that your projects will run smoothly. Don't miss out on the chance to work with a dedicated team that understands the importance of quality materials in your production process. Contact us today for detailed information about 2,4,5-Trifluorobenzonitrile pricing and availability! Your satisfaction is our priority.

CAS 98349-22-5,Buy 2 4 5-Trifluorobenzonitrile, C7H2F3N,2 4 5-Trifluorobenzonitrile price, 2 4 5-Trifluorobenzonitrile suppliers, 2 4 5-Trifluorobenzonitrile factory, 2 4 5-Trifluorobenzonitrile manuf Industry Leaders Leads the Global Market

In the ever-evolving world of chemical manufacturing, 2,4,5-Trifluorobenzonitrile (CAS 98349-22-5) stands out as a critical compound, particularly for industries such as pharmaceuticals, agrochemicals, and advanced materials. This specialty chemical, with the molecular formula C7H2F3N, is sought after for its unique properties, including its ability to act as an intermediate in the synthesis of various fluorinated compounds. As businesses look for reliable suppliers to meet their procurement needs, the demand for high-quality 2,4,5-Trifluorobenzonitrile is on the rise globally. Purchasing 2,4,5-Trifluorobenzonitrile involves more than finding a supplier; it requires selecting a reputable manufacturer that ensures product consistency and efficacy. Understanding the pricing landscape is essential for buyers to make informed decisions. Several factors influence the price of 2,4,5-Trifluorobenzonitrile, including production processes, quality assurance standards, and shipping logistics. Companies specializing in this compound should be prepared to offer competitive pricing while maintaining strict quality control measures. As the market for specialty chemicals continues to expand, forming partnerships with industry leaders can provide significant advantages. Suppliers and manufacturers dedicated to innovation and customer satisfaction will play a crucial role in shaping the future landscape of 2,4,5-Trifluorobenzonitrile distribution. Procurement teams should prioritize sourcing from manufacturers that not only offer high-quality products but also have a proven track record in serving global markets efficiently. Investing in strong supplier relationships is key to staying ahead in a competitive industry.

CAS 98349-22-5, Buy 2 4 5-Trifluorobenzonitrile, C7H2F3N, 2 4 5-Trifluorobenzonitrile price, 2 4 5-Trifluorobenzonitrile suppliers, 2 4 5-Trifluorobenzonitrile factory, 2 4 5-Trifluorobenzonitrile manuf Industry Leaders Leads the Global Market

| Supplier Location | Manufacturing Process | Annual Production Capacity (kg) | Certifications | Application |

|---|---|---|---|---|

| China | Chemical Synthesis | 5000 | ISO 9001, REACH | Pharmaceuticals, Agrochemicals |

| Germany | Fluorination | 3000 | ISO 14001, GMP | Specialty Chemicals |

| USA | Direct Fluorination | 2000 | FDA Approved | Fine Chemicals |

| Japan | Electrophilic Substitution | 2500 | ISO 9001, TSCA | Pharmaceutical Intermediates |

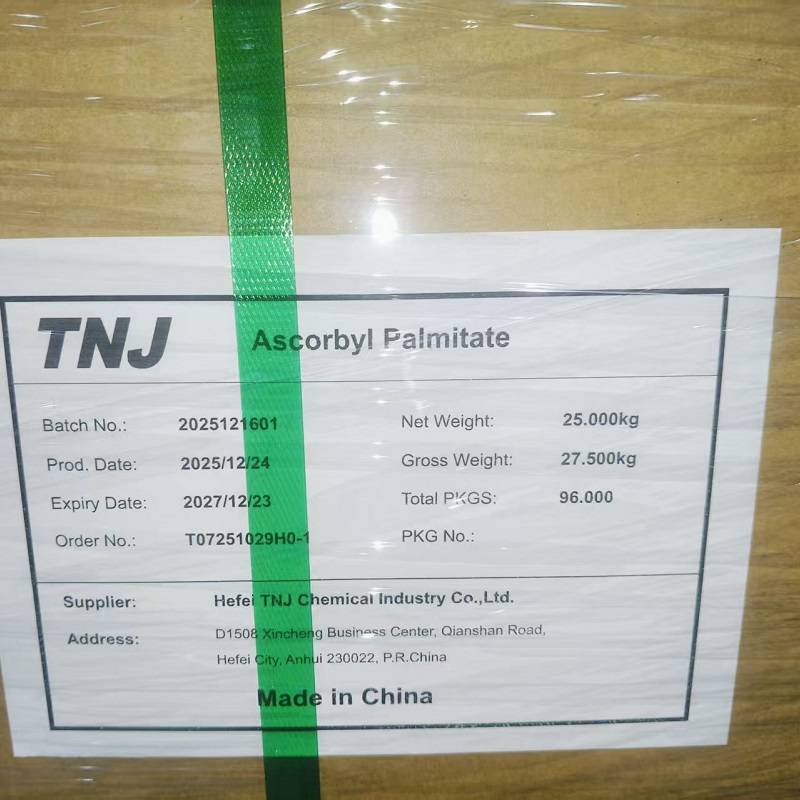

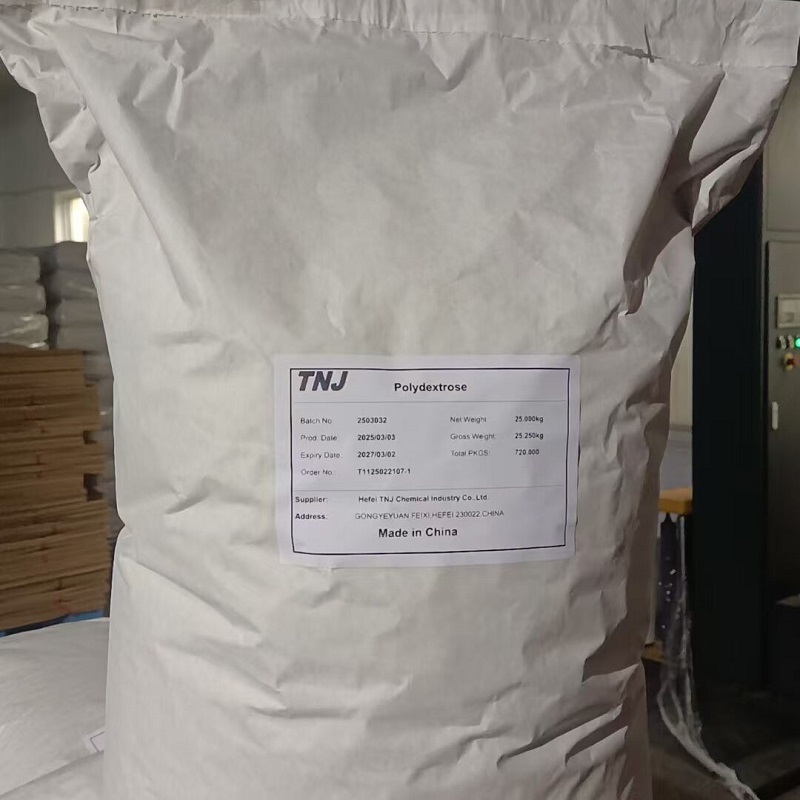

Related Products