Where to Find CAS 2425-79-8 (1,4-Butanediol Diglycidyl Ether) in China

If you’re searching for reliable sources to buy CAS 2425-79-8 (1 4-Butanediol diglycidyl ether) in China, I’m here to help! This versatile chemical compound, known for its strong adhesive properties and application in various industries, is easily accessible from several trusted manufacturers in the region. When considering your purchase, I always recommend checking the manufacturer’s reputation and product quality to ensure you get the best. China is home to numerous reputable suppliers who offer competitive pricing and bulk purchasing options, making it ideal for businesses looking to meet large demands. While exploring your options, I suggest reaching out directly to manufacturers to discuss specifications, safety information, and delivery times. By doing this, you can make an informed decision that aligns with your project requirements. Let’s find the right supplier together and ensure your operations run smoothly with high-quality 1 4-Butanediol diglycidyl ether!

Where to buy CAS 2425-79-8 (1 4-Butanediol diglycidyl ether) in China Dominates in 2025

In 2025, the demand for CAS 2425-79-8, commonly known as 1,4-Butanediol diglycidyl ether, is projected to surge globally, with China cementing its position as a leading supplier. This epoxy compound is integral in a variety of applications, including coatings, adhesives, and thermosetting resins due to its excellent properties such as low viscosity and high stability. As industries increasingly prioritize sustainable and high-performance materials, sourcing this chemical from reliable suppliers has become crucial for manufacturers worldwide. China's manufacturing prowess and investment in chemical processing technology have positioned it as a dominant player in the global market. Buyers looking for CAS 2425-79-8 will find a range of options in China, where quality control and competitive pricing align with rigorous international standards. Furthermore, the robust logistical infrastructure ensures timely delivery and ease of access for international buyers, catering to their evolving needs and diverse applications across multiple sectors. For global procurement agents and manufacturers, partnering with established suppliers in China can not only guarantee a steady supply of 1,4-Butanediol diglycidyl ether but also foster innovation through collaborative development efforts. As the market evolves, staying informed about trends and potential supply chain shifts will be essential for making strategic purchasing decisions. Embracing this opportunity will enable companies to enhance their product offerings and maintain a competitive edge in the rapidly changing landscape of industrial chemicals.

Where to buy CAS 2425-79-8 (1,4-Butanediol diglycidyl ether) in China Dominates in 2025

| Supplier Type | Region | Delivery Options | Regulatory Compliance | Sustainability Practices |

|---|---|---|---|---|

| Manufacturer | Eastern China | Express Delivery, Standard Shipping | ISO 9001 Certified | Recycling Program in Place |

| Distributor | Southern China | Next-Day Delivery, Freight Options | REACH Compliant | Green Energy Usage |

| Retailer | Northern China | Store Pickup, Nationwide Shipping | Hazardous Material Handling | Carbon Neutral Shipping |

| Online Marketplace | Central China | Two-Day Shipping, Local Delivery | MSDS Available | Plastic Waste Reduction Initiatives |

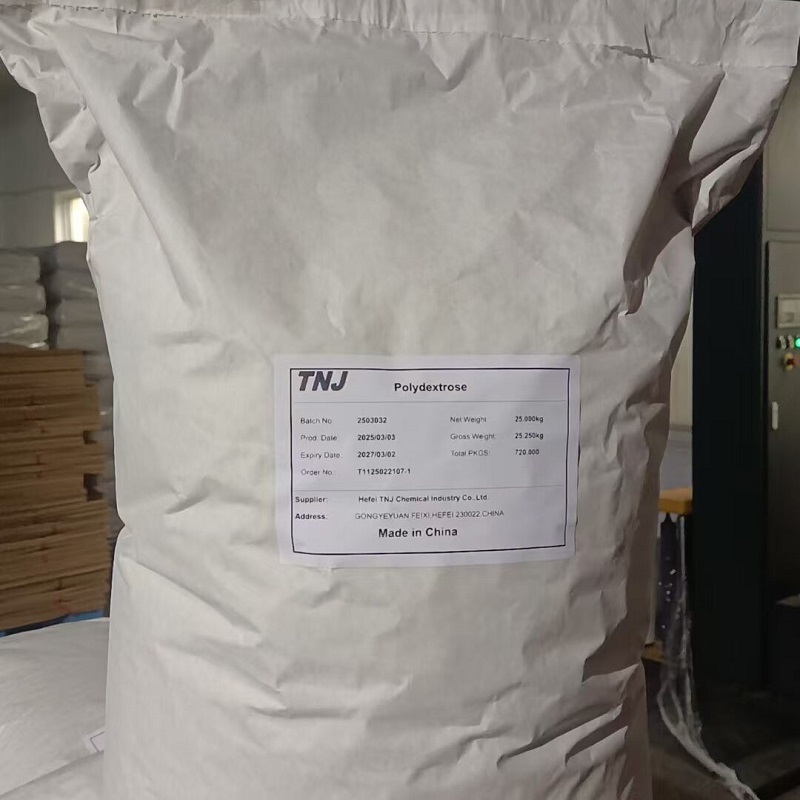

Related Products